Changing perceptions could bring outsized returns

April 6, 2021 2023-09-25 8:25Changing perceptions could bring outsized returns

Changing perceptions could bring outsized returns

Letter # 35

Had I started the sentence with, “past performance is not a guide to future,” you would have invariably presumed the ending to be, “please read scheme-related documents (or disclosure document in case of PMS) carefully before investing.” No, I do not intend to start the letter with a disclaimer. However, the stories I am about to share highlight how outsized returns (for investments, but more importantly, for nations) are generated when perceptions, formed by past actions, change.

In the last week of February 2021, the Director Generals of Military Operations (DGMO) of India and Pakistan, in a joint statement, agreed to strict observance of all agreements, understandings and ceasefires along the Line of Control (LoC) and all other sectors. The reaction to this on the Indian side was, at best a ‘yawn’, “nothing new, mate; we shall be back to square one within a few days.”

And, that is where the question of ‘past performance’ comes in. A ceasefire understanding between India and Pakistan was reached way back in November 2003, which paved the way for the Vajpayee-Musharraf meeting in Islamabad alongside the SAARC summit. This kickstarted the peace process from 2004 to 2008, before the whole thing was blown apart by the 26/11 Mumbai terror attacks by Pakistani terrorists. Then, in December 2013 again, DGMOs of both the countries met and agreed to ‘maintain the sanctity and ceasefire on the line of control.’ But, from 2014 onwards, tensions across the LoC rose and the agreement was in tatters.

Then, in 2018, for the third time, an agreement was reached by the two DGMOs to “fully implement the Ceasefire Understanding of 2003 in letter and spirit forthwith and to ensure that henceforth, the ceasefire will not be violated by both sides.” Alas, this too did not survive a couple of months and a record number of violation incidents were reported in 2020.

So, you might as well ask, “will this agreement be different?” I do not profess to know the answer. Frankly, I doubt if anyone knows; we will simply have to wait and see. But the 2021 agreement was followed up with a conciliatory speech by Pakistan’s Army Chief Bajwa. But, it is not just that; for Pakistan, it is simply getting too expensive to keep the rhetoric on.

Pakistan’s finances were far from stable even before the COVID-19 hit. With aggressive curbs on imports and massive devaluation of the currency, it was able to reduce its current account deficit, but economic growth fell from 5.6 percent in 2018 to 3.3 percent in 2019 and was expected to plunge to 2.4 percent in 2020 without the COVID-19 impact.

In 2019, it had already foregone an increase in defence budget and cut expenditure on health, education and other social services. In general, Pakistan is battling mammoth twin deficits, deteriorating forex reserves, weak currency, soaring sovereign debts and for the 13th time in three decades, it formally requested an IMF loan. Its public debt had reached close to 90 percent of GDP in 2020 and it was seeking bailouts from China and Saudi Arabia. Meanwhile, inflation had reached 15 percent in January 2020. Post-COVID-19, the situation has only turned for the worse.

Besides, geopolitically, it has to contend with a resilient India on the East, its dwindling importance for the US in Afghanistan and an overbearing China in the North. No surprise then that peace might suddenly start sounding a lot better option.

At the same time, India’s ability to fight a war on two and a half fronts is less than ideal as well. Its defence spending over the previous decade has barely kept pace with inflation and as we had pointed out here, rising naval spending are focused on expanding the commercial footprint. Given that India’s current dispensation, in its federal budget, appears to be finally focussing on economic expansion, a stable and peaceful border might not be a bad bargain.

India will most likely follow a ‘trust, but verify’ doctrine that the US followed towards the end of the cold war with the then USSR. But if Pakistan’s future actions are different from its past, the change in perception can drive higher rewards, both for Pakistan and India.

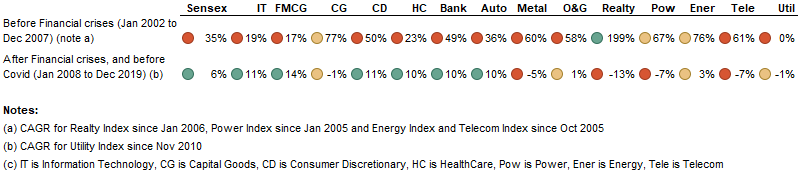

And, talking of changing perceptions bringing higher rewards for countries, let us talk about how it can drive stronger returns for investments. Before the onset of the global financial crisis (GFC) in 2007, sectors that had delivered superior returns were asset-heavy and capital spending driven (real estate, power, energy, telecom, capital goods). Businesses that are now considered ‘compounding stories’ (FMCG, information technology, healthcare) were among the worst performers back then.

The GFC and the subsequent meltdown in equity markets have exposed the froth in the best performing sectors prior to GFC. Since 2007 and before coroanvirus, the market’s attention had entirely shifted from capex stories towards consumption ones. FMCG, IT, durables, healthcare and automotive became the best performing sectors and realty, power, telecom and capital goods lagged the index’s performance.

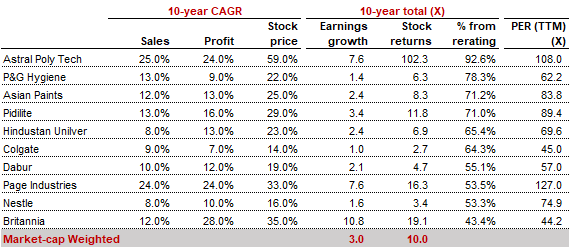

In the post-GFC world, things were different; consumption stories benefited immensely from a change in perception (see table below). Yes, these businesses did report strong growth in earnings, but the stock price performance in most cases was way ahead of the increase in profitability. On a market-capitalisation weighted average basis, these stocks, over the decade, were 10 baggers versus 3x increase in earnings.

The price of any stock has two components: (a) earnings; and (b) price to earnings multiple. While earnings growth could be relatively simple to forecast, the price to earnings multiple expands when the perception of business changes. Of course, there are technical factors as to what the justified valuations should be (price to earnings, EV to EBITDA or discounted cash flow), but the number of assumptions that go into those models makes PE ratio as much a ‘perception issue’ as much as it is a ‘technical issue’.

In conclusion, we saw how changing perceptions resulted in some sectors that were big outperformers during 2002-07 turn underperformers in the next cycle. Similarly, we also saw how investments in some businesses benefited disproportionately in the next cycle with changing perceptions. As investors, part of our job is obviously to gauge how earnings are likely to change over the next three to five years. However, if we get the change in perception right as well, the alpha generation (and investment returns) can be outsized.

Originally published here: Changing perceptions could bring outsized returns – cnbctv18.com

Disclaimers:

Information in this letter is not intended to be, nor should it be construed as investment, tax or legal advice, or an offer to sell, or a solicitation of any offer to make investments with Buoyant Capital. Prospective investors should rely solely on Disclosure Document filed with SEBI. Any description involving investment examples, statistical analysis or investment strategies are provided for illustration purposes only – and will not apply in all situations and may be changed at the discretion of principal officer. Certain information has been provided and/or based on third-party sources and although believed to be reliable, has not been independently verified; the investment managers make no express warranty as to its completeness or accuracy, nor can it accept responsibility for errors appearing herein.

Popular posts

- Jigar Mistry on Market Momentum | Is Another Sectoral Churn Coming?

- Fall Back on Hard Data Amid Market Noise | Jigar Mistry on CNBC TV18 | 09 May 2025

- ET Now | 11 April 2025 | India’s Market Moves Amid US Tariff Tensions

- CNBC TV18 | Closing Bell with Jigar Mistry | 7 April 2025

- ET Now | Jigar Mistry on Finding Opportunities in Market Weakness